What you need to know all about Personal Financial Planning, Risk Management , Wealth Accumulation, Wealth Creation, Wealth Preservation and Wealth Distribution. How and what to do for children education funding, retirement funding and etc ? Where to find help and advice and who to approach ? You can send in your enquiry to email: ttong3@gmail.com or call +603-20817435 or chat without any obligation.

Showing posts with label Services. Show all posts

Showing posts with label Services. Show all posts

Friday, July 10, 2015

Selamat Hari Raya 2015

Thursday, July 9, 2015

Umbrella for protection

Bought a 36 inch golf umbrella from the Zurich Head Office Kuala Lumpur yesterday morning . It was raining heavily and I wanted my client to remember insurance company are here to lend a helping hand in times of needs not like bank when something happen they will come after you for payment. This umbrella is to protect against financial loss due to premature death , total permanent or partial disable , 36 critical illness and hospitalization & surgical expenses. This is also one of the secret of success in prospecting .Do you know that there is also a umbrella policy ?

Labels:

Branding,

Events,

Promotions,

Services

Sunday, May 17, 2015

D.I.Y. Insurance

If you think of buying insurance , what will you do ?

Search the Internet / Google insurance to find out more information's ?

Or call your current Insurance Advisor and if no Insurance Advisor / Agents will you ask

for some referrals ?

I came across this D.I.Y insurance advertisement in the newspaper recently , will you do it yourself ?

I believe insurance must be sold . That's mean you need to facts find like what

is the current needs and amount of insurance need and what are the risks that

the person is looking for ? Example , medical insurance , living assurance such as

dread diseases , long term care , total permanent or premature death benefits ?

Please give us your feedback . Thank You.

Search the Internet / Google insurance to find out more information's ?

Or call your current Insurance Advisor and if no Insurance Advisor / Agents will you ask

for some referrals ?

I came across this D.I.Y insurance advertisement in the newspaper recently , will you do it yourself ?

I believe insurance must be sold . That's mean you need to facts find like what

is the current needs and amount of insurance need and what are the risks that

the person is looking for ? Example , medical insurance , living assurance such as

dread diseases , long term care , total permanent or premature death benefits ?

Please give us your feedback . Thank You.

Labels:

Contact Us,

Events,

Feed Back,

Products,

Promotions,

Services

Friday, January 2, 2015

MedicaLife 210E

Comprehensive medical protection for those who truly love

A comprehensive medical protection for the ones you love.

These days, medical insurance is no longer a luxury; it is essential. With medical costs spiralling upwards in recet years, it is only wise for all of us to have medical insurance, to make sure we are protected against medical emergencies as we age.

MedicaLife 210E is a hospitalisation and surgical policy especially designed for those who are concerned about rising medical costs and understand the importance of having comprehensive medical protection up to a ripe old age.

With 4 comprehensive plans to choose from, MedicaLife 210E is a ideal plan for you to protect your loved ones.

A comprehensive medical protection for the ones you love.

These days, medical insurance is no longer a luxury; it is essential. With medical costs spiralling upwards in recet years, it is only wise for all of us to have medical insurance, to make sure we are protected against medical emergencies as we age.

MedicaLife 210E is a hospitalisation and surgical policy especially designed for those who are concerned about rising medical costs and understand the importance of having comprehensive medical protection up to a ripe old age.

With 4 comprehensive plans to choose from, MedicaLife 210E is a ideal plan for you to protect your loved ones.

Thursday, August 8, 2013

Selamat Hari Raya Aidilfitri

Early Care Critical Illness

Critical illness can occur when you least expect them. Minimize the risk through early detection by getting the right treatment and peace of mind. Zurich Insurance Malaysia offers coverage for Early Care Critical Illness. Early Care Critical Illness plan is designed to support you financially , no matter if it is at early or end stage of the critical illness.

- Receive 50% payout at the early stage of critical illness.

- Receive 100% payout at the end stage of critical illness.

- 12% Rehabilitation Benefits to aid complete recovery

- Lump sum payout of Rm 2000 for second medical opinion.

Monday, November 19, 2012

Zurich Sales Advisors

Eligibility

If this is you then you may be eligible for the program -

1.You have a business, or want to SERIOUSLY get into business (i.e. you have taken some steps)

2.You are between the ages of 18 -- 25

3.Your turnover is from $0 -- $750K annually

4.You want to be working ON the business, and not IN it

5.You want to ACCELERATE, EXPAND and GROW the business beyond yourself

Don't sign up unless you are really committed

This is the one thing we ask.

There is a lot to execute and deliver -- so only join up if you are willing to

get stuff done and create some serious IMPACT. Otherwise you are wasting your time.

Your Reward

Contact TOP 1 AGENCY No: 016-2328717

Tuesday, November 13, 2012

Sunday, October 21, 2012

Leader Effectiveness Program

Attended the Leader Effectiveness Program at Country Heights Resort and Leisure, Kajang from 17th October to 19th October 2012. This program was conducted by Zurich Insurance Malaysia Berhad. It is a training course designed especially for Agency Leaders. It is also a LIAM 's ( Life insurance Association Malaysia) mandatory program for all newly promoted Agency Managers that need to be completed within the first year of their promotion.

Course Objectives:

Course Objectives:

- To promote systematic recruiting methodologies.

- To enhance agency leaders training skills in conducting an effective sales cycles program

- To build a systematic sales activity tracking / monitoring habit for agency leaders.

Thursday, October 4, 2012

Zurich FlexiLife

Protection that grows with you..........On 1st October;2012 , Zurich Insurance Malaysia Berhad have launched a new Investment Link Policy call Zurich FlexiLife together with a Hospital Income Rider.

Zurich FlexiLife policy has a loyalty bonus. This is a brand new feature to the policyholders. You can choose the level of Protection, Savings and Investment you need , all in one flexible policy.

Zurich FlexiLife provides a Loyalty Bonus of an additional 2% of the lowest premium collected over the last 3 premium years and is payable in the fourth (4th) premium year.

And as long as you keep making your premium payments on time, you will continue to enjoy the bonus on the sixth (6th), eight (8th), tenth (10th), twelfth(12th), fourteen (14th) and sixteenth (16th) premium year.

Loyalty Bonus is only payable in the form of unit purchase and excludes premiums paid for regular top-up and irregular top-up.

Hospital Income Rider to offset co-insurance in MaxMedic and provide additional income when hospitalised.

Zurich FlexiLife provides a Loyalty Bonus of an additional 2% of the lowest premium collected over the last 3 premium years and is payable in the fourth (4th) premium year.

And as long as you keep making your premium payments on time, you will continue to enjoy the bonus on the sixth (6th), eight (8th), tenth (10th), twelfth(12th), fourteen (14th) and sixteenth (16th) premium year.

Loyalty Bonus is only payable in the form of unit purchase and excludes premiums paid for regular top-up and irregular top-up.

We might be Life Agents, But we see ourselves as life Advisors.

Need help in determining your insurance needs?

As Zurich Sales Advisor I will be happy to assist you to :

- Understand everything you need to know about insurance and why it is important

- Choose the benefits that are most suitable for you

- Help you decide on how much you need to protect yourself and your loved ones.

- Make a plan that fits within your budget

Just contact Tony at 019-3234605 or email me at ttong3@gmail.com for assistance today

Labels:

Contact Us,

Products,

Promotions,

Services

Saturday, September 15, 2012

Happy Malaysia Day

This morning while reading the Star Newspaper I come across this advertisement put up by our company

Zurich Insurance Malaysia Berhad. I very happy that we all Malaysian celebrate this day. The following are the excerpt.

Zurich and Malaysia rising together.

As we celebrate Malaysia Day , Zurich looks forward to a future shared with Malaysians across the nation. Formerly known as MAA Assurance, Zurich Insurance Malaysia is a global company that benefits from a wealth of local knowledge. Do call us today if you have questions about life and general insurance. To find out more about Zurich and our roots in Malaysia , visit heritage.zurich.com.my.

On this 49th Malaysia Day, our commitment is to advance together with the nation, so that a better tomorrow is assured for all.

Zurich . Putting the "sure " in insurance.

Call 1-300-888-622 or visit www.zurich.com.my

Zurich Insurance Malaysia Berhad. I very happy that we all Malaysian celebrate this day. The following are the excerpt.

Zurich and Malaysia rising together.

As we celebrate Malaysia Day , Zurich looks forward to a future shared with Malaysians across the nation. Formerly known as MAA Assurance, Zurich Insurance Malaysia is a global company that benefits from a wealth of local knowledge. Do call us today if you have questions about life and general insurance. To find out more about Zurich and our roots in Malaysia , visit heritage.zurich.com.my.

On this 49th Malaysia Day, our commitment is to advance together with the nation, so that a better tomorrow is assured for all.

Zurich . Putting the "sure " in insurance.

Call 1-300-888-622 or visit www.zurich.com.my

Thursday, August 23, 2012

Zurich Insurance Advisors

Why you want to be an Insurance Advisors ?

- Build Your Own Career

As Insurance Advisor, you will be helping thousands of families. How ? To achieve the financial security needed to secure a better life. Besides that, you will also be contributing to the community by providing them with advice on protection, risk mangement and investment plans. By making a difference in people's lives is more satisfying and fulfilling than you can ever imagine. This is a very noble profession. There are many others motivating and compelling reasons why you should consider building your own business with an Agency in Zurich Insurance Malaysia Berhad: - Unlimited income

The Sky Is The Limit . There is no limit to how much you can earn. The better your performance, the higher your income. You have the freedom to set your own pace and income objectives. As an Insurance Advisor, you determine your own income potential. - Be Your Own Business

As an Insurance Advisor, you establish and decide your own career path. You have the absolute freedom to manage your own time and develop your own business strategies. - Attractive Benefits Package

Not only do we offer lucrative commission scheme and monetary incentives, there are also attractive fringe benefits for which you may qualify. In addition, we also offer reimbursement for academic courses related to your profession. - Continuous Learning "Learn, Unlearn and Relearn"

Gain professional knowledge. Develop a positive attitude. Discover your potential. With Training and Development Dept in Zurich Insurance Malaysia Berhad, you embark on a lifetime of learning and professional development through comprehensive and advanced training in financial planning. Our sophisticated training program is designed to equip you with sales and marketing skills.

Wednesday, August 22, 2012

Zurich Insurance Business Opportunity

Saturday, March 31, 2012

Hangzhou Contest

Join The Winning Team.............Be A Winner Today !We are looking for strong and motivated individuals to join us as financial consultants.

We continue to provide protection, savings and investment for Malaysians.

Join us today and win yourself a trip to Hangzhou, China with APE Rm80,000

Call Tony Tong at 019-3234605 or email me at ttong3@gmail.com

We continue to provide protection, savings and investment for Malaysians.

Join us today and win yourself a trip to Hangzhou, China with APE Rm80,000

Call Tony Tong at 019-3234605 or email me at ttong3@gmail.com

Wednesday, March 2, 2011

Donations

Yesterday went to our MAA customer service and cashier counter at Menara MAA and saw this flyer around one of the donation boxes. "Every day, more than 10 Malaysians are tested positive for HIV and there are nearly 87,000 People Living with HIV nationwide"

Your kind donations will go directly to the Medicine Assistance Scheme, a unique initiated by the Malaysia AIDS Foundation that funds the medication for underprivileged Malaysians infected with HIV.

YOUR SMALL CHANGE WILL GO A LONG WAY IN MAKING A DIFFERENCE IN THEIR LIVES SO PLEASE JOIN US IN HELPING THEM.

For more information contact the Malaysian AIDS FOUNDATION at +603-40451033 or email us at contactus@mac.org.my in partnership with MAA Assurance Faizral Tahir

Faizral Tahir

Your kind donations will go directly to the Medicine Assistance Scheme, a unique initiated by the Malaysia AIDS Foundation that funds the medication for underprivileged Malaysians infected with HIV.

YOUR SMALL CHANGE WILL GO A LONG WAY IN MAKING A DIFFERENCE IN THEIR LIVES SO PLEASE JOIN US IN HELPING THEM.

For more information contact the Malaysian AIDS FOUNDATION at +603-40451033 or email us at contactus@mac.org.my in partnership with MAA Assurance

Faizral Tahir

Faizral TahirRelated articles

- Malaysian women in conservative state hit by HIV - report (newsinfo.inquirer.net)

Saturday, January 15, 2011

See you in Italy

"Ci vediamo in Italia !" See you in Italy !

Lets fly with us to ROME, ITALY

This year MAA 29th Submit Club Convention trip is to Rome , Italy. Rome is a historic city full of arts, churches, monuments and palazzo, is being described as a gigantic open air museum because every stones tell a story.Its almost 10 years I have been to Europe.

Fontana di Trevi- Rome, Italy

Tradition has it that throwing a coin over your left shoulder into the fountain guarantees a swift return to the world's most beautiful city.

Colosseum.No visit to Rome is complete without seeing its magnificent Colosseum, a vast amphitheater with seating for 55,000 that was designed as a horse racing circuit and arena for animal fighting and gladiatorial battles. This year target is RM198,000. If you achieve this target you will get 1 ticket free trip to Rome.

Lets fly with us to ROME, ITALY

This year MAA 29th Submit Club Convention trip is to Rome , Italy. Rome is a historic city full of arts, churches, monuments and palazzo, is being described as a gigantic open air museum because every stones tell a story.Its almost 10 years I have been to Europe.

Fontana di Trevi- Rome, Italy

Tradition has it that throwing a coin over your left shoulder into the fountain guarantees a swift return to the world's most beautiful city.

Colosseum.No visit to Rome is complete without seeing its magnificent Colosseum, a vast amphitheater with seating for 55,000 that was designed as a horse racing circuit and arena for animal fighting and gladiatorial battles. This year target is RM198,000. If you achieve this target you will get 1 ticket free trip to Rome.

Annual Planning Conference

Attended the Annual Planning Conference 2011 in Melaka from 11th Jan to 13th Jan . This event is an annual event for consultants who had meet their sales target. We stayed in Avillion Legacy hotel in Jalan Hang Tuah Melaka. It took me 2 hours to reached there from my office at Menara MAA. MAA Assurance target this year is Rm155 million on new business and to recruit 1500 new consultants. MAA Assurance also aggressive advertised in The Malay Mail. This advertisement was on Tuesday 11th Jan 2011 front page.

If you're between age 28-38 years old, have profitable business contacts and want to receive an additional Rm3,000-Rm5,000 on top of your quarterly Group Sales Performance Incentives.................

Come and talk to us.

We will get you a big piece of the action!

ACT NOW, YOUR FUTURE IS TODAY

If you're between age 28-38 years old, have profitable business contacts and want to receive an additional Rm3,000-Rm5,000 on top of your quarterly Group Sales Performance Incentives.................

Come and talk to us.

We will get you a big piece of the action!

ACT NOW, YOUR FUTURE IS TODAY

Thursday, December 30, 2010

New Year Gathering 2011

To: Clients, Investors and Policyholders:

Happy New Year ! MAA Assurance has great pleasure in inviting you to our New Year Gathering. We have invited Mr Soon Teck Onn our MAA Fund Manager to give us a talk Market Outlook 2011 on what to expect and investing strategy. Encik Hilmy Darmin from Investment Link Plans deptartment will also sharing with us on the benefits of our Investment products such as MIP and MSP.

Date : 6th Jan 2011

Time : 7.00 pm to 10.00 pm

Venue : Charlie's Reserve. Menara MAA

PROGRAMS:

7.00 -7.30 pm Arrival of guests

7.30 - 8.30pm Dinner

8.30 - 9.00pm Market Outlook 2011

9.00 - 9.30pm Sharing by Hilmy Darmin

9.30 - 10.00pm Lucky Draw

For reservations please call Tony at 019-3234605

Happy New Year ! MAA Assurance has great pleasure in inviting you to our New Year Gathering. We have invited Mr Soon Teck Onn our MAA Fund Manager to give us a talk Market Outlook 2011 on what to expect and investing strategy. Encik Hilmy Darmin from Investment Link Plans deptartment will also sharing with us on the benefits of our Investment products such as MIP and MSP.

Date : 6th Jan 2011

Time : 7.00 pm to 10.00 pm

Venue : Charlie's Reserve. Menara MAA

PROGRAMS:

7.00 -7.30 pm Arrival of guests

7.30 - 8.30pm Dinner

8.30 - 9.00pm Market Outlook 2011

9.00 - 9.30pm Sharing by Hilmy Darmin

9.30 - 10.00pm Lucky Draw

For reservations please call Tony at 019-3234605

Wednesday, December 29, 2010

Financial Knowledge crucial

![[10995314_BG2.jpg]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiceSQaFYTjU9zFfXdo4oVDAEmZS0KxwSt4ZT4uGaMEcAt6sudcWjDdTuBqBnWTPfiYNS9tyUsvL0roM7sNNBAncQez67wkCVbxNYEJzBvmY6Ct6SIMjBrbgfNP_GQV-BMEn18Z-k2-opI/s1600/10995314_BG2.jpg) PETALING JAYA: Young adults need to be equipped with the essential financial knowledge to avoid them from falling into “financial trap” that usually snares them at a later stage in life. Statistics from Credit Counselling and Debt Management Agency (AKPK) showed that 44% of its debt management programme (DMP) customers were 30 to 40 years old, mainly males (67.9%) and earning below RM36,000 nett a year. Only 16% of the DMP customers were below 30 years old.

PETALING JAYA: Young adults need to be equipped with the essential financial knowledge to avoid them from falling into “financial trap” that usually snares them at a later stage in life. Statistics from Credit Counselling and Debt Management Agency (AKPK) showed that 44% of its debt management programme (DMP) customers were 30 to 40 years old, mainly males (67.9%) and earning below RM36,000 nett a year. Only 16% of the DMP customers were below 30 years old.Chief executive officer Akwal Sultan said many young adults aged 30 and above came to AKPK when they had lost control of their finances, which might have started at an earlier age. Mohamed Akwal Sultan says young adults should take control of their finances.

“They could have taken control of things earlier if they were aware of the steps needed to lead a prudent lifestyle,” he told StarBiz.

Akwal said although there was a general consensus that young adults had issues in managing their money, especially when it involved credit card, the overall non-performing loan statistics of credit cards was only 1.9%.

“It is only pockets of young adults that have problems with credit cards, contributed mostly by a lifestyle issue,” he said.

Akwal added that only 9.4% of those under the DMP faced credit card problems while 73.5% faced difficulties in managing a combination of debt, which include car loans, credit cards, personal loans and housing loans.

Thus, Akwal said there was a need for a more effective financial education programme for the young generation.

“Although it is currently being taught in schools, it is still not a subject by itself and thus does not have the desired results. At the tertiary level, the need for an effective financial education programme becomes more critical as having graduates savvy in this area will better equip them to handle their finances.

“In short, financial education is a baseline education that all individuals, especially today's young adults, should have,” he said.

National deposit insurer Malaysia Deposit Insurance Corp (PIDM) chief operating officer Md Khairuddin Arshad said sound financial knowledge, particularly about savings and prudent spending, must be inculcated among the young generation.

“Knowledge about deposit insurance should also be part of this foundation, especially as our youths prepare themselves for working life.

Sound financial know ledge, particularly about savings and prudent spending, must be inculcated among the young generation.

“By the time they take up their first job and start a family, they should already be capable of making smart and informed financial decisions and continue to do so throughout their lives,” he said.

OCBC Bank (M) Bhd head of wealth management Ong Shi Jie said the younger generation needed to obtain basic money management skills which included budgeting, the use of credit cards and accounts checking, and the importance of savings.

“In the course of our lives, we will eventually need a credit card, mortgage or a savings account to manage our finances.

“In this regard, it remains strange that the basic skills of managing finances have not been institutionalised into our education system,” she said.

Ong said most young adults fell into the “financial trap” the minute they landed a job because the first thing they normally did was to apply for a credit card.

“This gets them into the vicious cycle of succumbing to all their wants, not needs. So, before they make their first investment or saving, they're saddled with credit card debts and a loan for a depreciating car value.

“It's no wonder why people worry about retirement plans 10 years too late. They're paying for the sins' of their early years,” she said, adding that such financial traps needed to be pre-empted by instilling sensible money management habits in children.

Although Malaysia has one of the highest personal savings rates in the world, Ong said this had been largely driven by Government policies as opposed to a higher level of financial knowledge like in other countries.

“There is definitely room for improvement as far as the current level of financial knowledge among our young adults is concerned,” she said.

In terms of programmes, AKPK's ongoing focus is to provide financial education to post-secondary and tertiary level audiences where numerous financial education programmes are already in place since its inception four years ago.

These include National Service interactive workshops and module infusion in 31 institutions of higher learning. Bank Negara has also recently announced that a new financial capability programme will be launched next year, to be offered by AKPK.

As for PIDM, it has implemented an education programme for secondary school and tertiary students throughout Malaysia as part of its ongoing initiatives to further enhance public understanding of deposit insurance.

PIDM MoneySmart project seeks to instil the habit of savings and prudent financial management among students in schools and higher-learning institutions.

For OCBC, one of its recent initiatives is the OCBC Mighty Savers. For example, its OCBC Mighty Savers Weekend offers basic banking products and services to children at selected branches on every first weekend of the month.

Many young adults seeking advice on debt managementBy SHARIDAN M. ALI sharidan@thestar.com.my

Sunday, December 26, 2010

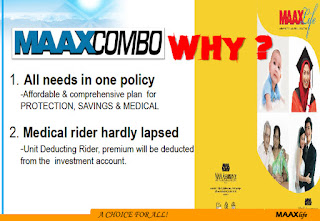

MAAXCOMBO

MAAXCOMBO is our MAA Assurance latest investment link insurance policy. The features are :

The comprehensive PROTECTION, MEDICAL AND SAVINGS

plan for everyone.

Proposed riders packaged with MAAXLife

MaaxMedic

A comprehensive and affordable medical plan that is guaranteed renewble up to age 80, designed exclusively to complement Maaxlife.

P.A.EVO

A comprehensive Personal Accident rider

Critical Illness Super

Provides additional protection in the event the insured is diagnosed with critical illness without affecting the Basic sum Assured

Waiver of Premium on Dread Diseases

the future premiums will be waived when the insured is diagnosed to be suffering from dread diseases.

Benefits :

ALL needs in one policy

All-In-One Protection Plan Starts With Your Smart Idea!

The comprehensive PROTECTION, MEDICAL AND SAVINGS

plan for everyone.

Proposed riders packaged with MAAXLife

MaaxMedic

A comprehensive and affordable medical plan that is guaranteed renewble up to age 80, designed exclusively to complement Maaxlife.

P.A.EVO

A comprehensive Personal Accident rider

Critical Illness Super

Provides additional protection in the event the insured is diagnosed with critical illness without affecting the Basic sum Assured

Waiver of Premium on Dread Diseases

the future premiums will be waived when the insured is diagnosed to be suffering from dread diseases.

Benefits :

ALL needs in one policy

- Affordable

- Comprehensive

- 4 in 1

- Medical rider hardly lapsed

All-In-One Protection Plan Starts With Your Smart Idea!

Subscribe to:

Posts (Atom)